All Categories

Featured

Table of Contents

Mortgage life insurance policy gives near-universal coverage with minimal underwriting. There is typically no medical checkup or blood sample needed and can be an important insurance plan choice for any type of homeowner with serious preexisting clinical conditions which, would avoid them from acquiring conventional life insurance policy. Various other benefits consist of: With a home mortgage life insurance coverage plan in position, beneficiaries won't have to fret or question what may take place to the family members home.

With the home loan settled, the family will always belong to live, offered they can manage the residential property taxes and insurance policy yearly. what life insurance do i need for a mortgage.

There are a couple of different sorts of mortgage defense insurance policy, these consist of:: as you pay even more off your home loan, the amount that the policy covers minimizes according to the outstanding equilibrium of your mortgage. It is the most common and the most inexpensive type of mortgage protection - house insurance for mortgage.: the quantity guaranteed and the costs you pay stays level

This will pay off the home loan and any kind of continuing to be balance will go to your estate.: if you wish to, you can add serious illness cover to your home loan security plan. This implies your mortgage will be gotten rid of not only if you pass away, but likewise if you are detected with a major ailment that is covered by your plan.

Mortgage Job Loss Insurance

Furthermore, if there is an equilibrium remaining after the home loan is cleared, this will certainly go to your estate. If you change your home mortgage, there are numerous points to take into consideration, depending upon whether you are topping up or extending your mortgage, switching, or paying the home loan off early. If you are topping up your mortgage, you require to see to it that your policy satisfies the new value of your home loan.

:max_bytes(150000):strip_icc()/insurance_final-636cb6bc31de489f836f16f029289faf.jpg)

Contrast the costs and advantages of both options (home mortgage protection). It may be more affordable to maintain your initial mortgage protection plan and after that acquire a second plan for the top-up amount. Whether you are covering up your home loan or prolonging the term and require to obtain a brand-new policy, you may find that your costs is greater than the last time you obtained cover

Mppi Cover

When changing your home loan, you can assign your home mortgage protection to the new loan provider. The costs and level of cover will coincide as before if the amount you obtain, and the regard to your mortgage does not transform. If you have a policy via your lending institution's group plan, your lending institution will certainly cancel the plan when you change your mortgage.

There won't be an emergency situation where a huge expense schedules and no chance to pay it so not long after the death of a loved one. You're giving satisfaction for your family members! In The golden state, home mortgage protection insurance policy covers the entire exceptional equilibrium of your funding. The survivor benefit is an amount equivalent to the equilibrium of your home loan at the time of your passing.

Unemployment Mortgage Protection Insurance

It's necessary to comprehend that the fatality benefit is given straight to your lender, not your loved ones. This guarantees that the staying debt is paid in complete and that your liked ones are saved the financial stress. Home loan security insurance can likewise supply short-lived protection if you become disabled for an extended period (generally 6 months to a year).

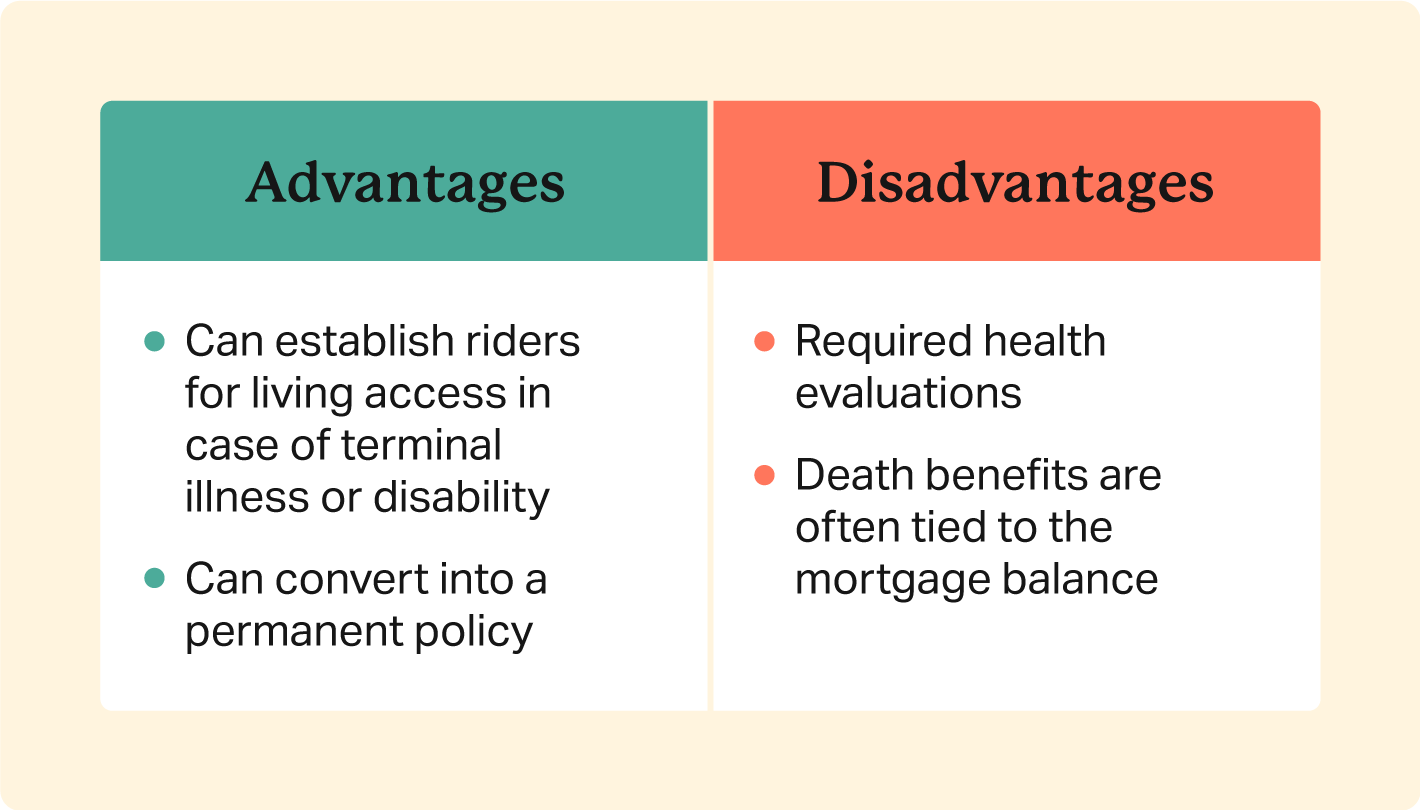

There are many advantages to obtaining a home mortgage protection insurance plan in California. A few of the top benefits consist of: Guaranteed authorization: Even if you remain in inadequate wellness or operate in a harmful occupation, there is guaranteed authorization with no medical examinations or lab tests. The exact same isn't real permanently insurance coverage.

Handicap protection: As stated above, some MPI policies make a couple of home loan settlements if you come to be disabled and can not generate the very same revenue you were accustomed to. It is essential to keep in mind that MPI, PMI, and MIP are all various kinds of insurance. Mortgage security insurance coverage (MPI) is made to pay off a mortgage in case of your fatality.

Homeowner Insurance Vs Mortgage Insurance

You can also use online in minutes and have your policy in position within the very same day. To learn more about obtaining MPI protection for your home finance, contact Pronto Insurance today! Our educated agents are below to address any type of inquiries you may have and give further assistance.

MPI offers a number of benefits, such as peace of mind and streamlined qualification processes. The fatality benefit is directly paid to the lender, which limits flexibility - mortgage loan insurance premium. Additionally, the advantage quantity decreases over time, and MPI can be more expensive than conventional term life insurance coverage plans.

Will I Need Mortgage Insurance

Go into basic details about on your own and your home loan, and we'll contrast rates from various insurance companies. We'll additionally reveal you just how much insurance coverage you require to safeguard your home loan.

The main advantage right here is clearness and confidence in your choice, knowing you have a plan that fits your needs. When you approve the strategy, we'll deal with all the documents and arrangement, guaranteeing a smooth implementation process. The positive result is the assurance that features recognizing your family is safeguarded and your home is safe, no issue what occurs.

Specialist Suggestions: Support from seasoned experts in insurance policy and annuities. Hassle-Free Arrangement: We handle all the documents and application. Cost-Effective Solutions: Locating the most effective coverage at the cheapest feasible cost.: MPI especially covers your home mortgage, offering an extra layer of protection.: We function to find the most affordable services customized to your budget.

They can give details on the insurance coverage and benefits that you have. Usually, a healthy and balanced person can expect to pay around $50 to $100 monthly for home mortgage life insurance policy. Nevertheless, it's recommended to get a tailored mortgage life insurance quote to obtain an exact quote based upon private circumstances.

Latest Posts

Funeral Cover Prices

Final Expense Services

Low Cost Final Expense Insurance